additional tax assessed by examination

As a general rule the IRS must assess additional tax and propose penalties no later than 3 years after either a tax return is filed or the returns due date whichever is later. Upon looking into my account online I found that I have been charged code 290 Additional tax assessed 240.

Price Quotation Templates With And Without Tax Excel Templates Excel Templates Quotations Templates

Generates TC 421 to release 42 Holdif Disposal Code 1-5 8-10 12 13 34 and TC 420 or 424 present.

. TC 300 Additional Tax or Deficiency Assessment by Examination Division or Collection Division. Theres no way to tell just looking at the transcript. Adjustments to income or deduction items dont affect or warrant a change in tax liability or refundable credits on.

When the IRS selects a tax. Individual Master File IMF Audit Reconsideration is the process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid or a tax credit was reversed. An audit reconsideration is defined by the Internal Revenue Manual IRM as.

Additional Assessment this means more tax is due If however SARS is of the view that your supporting documents do not match your tax return they may issue you an Additional Assessment. An assessment is the recording of the tax debt on the books of the IRS. In employment tax examinations where any worker classification issue was examined and accepted and other non-IRC 7436 issues are adjusted.

Normally the IRS will use the form for the initial report only and the IRS reasonably expects agreement. Ask a lawyer - its free. The tax code 290 Additional Tax Assessed usually appears on your transcript if you have no additional tax assessment.

79 rows Individual Master File IMF Audit Reconsideration is the process the. Just noticed on my transcript additional tax assessed 000 right around the time i filled in Jan. 575 rows Additional tax assessed by examination.

421 closed examination of tax return 12102020 290 additional tax assessed. 575 rows Additional tax assessed by examination. 290 means additional assessment of.

The meaning of code 290 on the transcript is Additional Tax Assessed. In determining if more than 25 has been omitted capital. Just sitting in received.

Agreement to Assessment and Collection of Additional Tax and Acceptance of Overassessment. You can request Wage and Income Transcripts from IRS httpwwwirsgovIndividualsGet-Transcript and compare the numbers reported to IRS. June 3 2019 1022 AM.

4425141 Follow-up on Form 3552. It may be disputed. Valrie Chambers PhD CPA.

A special assessment tax is a local tax in addition to property taxes that is levied on homeowners to fund a specific project. If that occurs the IRS generally has 60 days from the receipt of the return to assess additional tax. 575 rows Additional tax assessed by examination.

Possibly you left income off your return that was reported to IRS. I received a notice from the IRS that I owed some taxes from 2017 of which I was unaware. Agreed income tax changes.

Assessment of additional tax. Posted on Jan 7 2021. Additional assessment is a redetermination of liability for a tax.

The term additional assessment means a further assessment for a tax of the same character previously. If the taxpayer disagrees with the original determination he. Possibly you left income off your return that was reported to IRS.

The process the IRS uses to reevaluate the results of a prior audit where additional tax was assessed and remains unpaid or a tax credit was reversed. They can request additional tax payments during this time or perform any type of. 442513 Follow-up on Quick Assessment Form 3210 CCP or Campus Examination Procedures.

4425141 Follow-up on Form 3552. IRS says I owe an additional 7568 for the year of 2018 from Additional Tax assessed by examination. Form 4549 Income Tax Examination Changes is used for cases that result in.

This usually happens when SARS disallows some of your expenses and therefore issues an Additional Assessment showing the extra tax that is due. January 1 2016. Code 290 Additional Tax Assessed on transcript following filing in Jan.

The following is an example of a case law which defines an additional assessment. Additional Assessment Law and Legal Definition. Complete the following sentences by clicking on the correct answer.

Assesses additional tax as a result of an Examination or Collection Adjustment to a tax module which contains a TC 150 transaction. An IRS examination of a tax return may trigger an audit. Is the agreement form to be used in two situations.

442515 Second Adjustment Document Form 5344 or Form 5403 CCP Responsibility. A listing of additional requirements to. What do I do.

575 rows Additional tax assessed by examination. Additional Tax or Deficiency Assessment by Examination Div. It is a further assessment for a tax of the same character previously paid in part.

Youll have to call the IRS for an explanation. 442514 Quick Assessment Verification Form 3552 CCP or Campus Examination Procedures. Additional tax assessed 00-00- Tax relief credit Notice issued NOTICE-1444 A in ted re resentative Refund issued Additional tax assessed 00-00.

Examples of Tax Assessment in a sentence. The term additional assessment means a further assessment for a tax of the same character previously. You understated your income by more that 25 When a taxpayer under reports his or her gross income by more than 25 the three-year statute of limitations is increased to six years.

I was accepted 210 and no change or following messages on Transcript since. Additional tax assessed basically means that IRS did not agree with the original amount assessed and increased the tax you owe. If you dont have a members TFN you may be liable for additional.

How Much Do Accountants Charge For Tax Preparation Tax Preparation Tax Tax Refund

Energy Audit Word Cloud Stock Vector Ad Word Audit Energy Vector Ad Word Cloud Energy Audit Words

Economics Taxes Economics Notes Study Notes Accounting Notes

Coaches Report Template 2 Templates Example Templates Example Report Template Coaching Job Coaching

Free Torrens Title Form Real Estate Forms Online Real Estate Legal Forms

Rates For Regular Gym Memberships At Miracles Fitness At The Garage Ocean View Gym Membership Fitness Membership Garage Gym

A Notice Of Assessment Or Noa Is A Statement From The Canada Revenue Agency Notifying The Taxpayer Of The Amount Of Tax They Assessment Tax Credits Income Tax

Hoa Assessments Dues Vs Hoa Special Assessments Www Westcoastescrow Com Escrow Escrow101 Realestate Title Insurance Escrow Home Buying Tips

Printable Basic Skills Assessment Template Sample Management Skills List Of Skills Assessment

About Tutor Mr Wynn Khoo For More Information Contact Admin Poatuition Com Sg Http Www Poatuition Com Tel 81356556 Tuition Tuition Centre Tutor

Pin On Career Center Resources

Pin By Sonal Bisht On Gst Good Service Tax Consultants In Chandigarh Goods And Services Goods And Service Tax Accounting Services

Pin On Poa Tuition In Singapore

Rate Of Family Pension Of Bank Employees And Increase In Rate Of Contribution Under Cpf Pensions Bank Financial Services

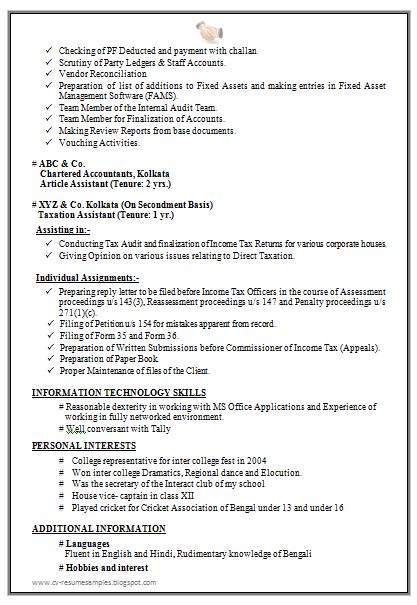

Professional Experienced Chartered Accountant Resume Sample 2 Accountant Resume Business Analyst Resume Job Resume

Get Audit And Tax Services Mumbai Ahmedabad Nexr Tax Services Audit Tax